This is How We All Win

Follow ARTISH on Twitter and Instagram

Hello Collective,

We have been in the studio working hard on our next masterpiece: The ARTISH App.

As the world gears towards a borderless, blockchain-based digital economy, we want to give creators and freelancers access to a resource tool that will give them the edge to thrive in the economies of the future. This is our endgame to revolutionising the future of digital work in Africa, once and for all.

And we have our approach to doing this, down to a science.

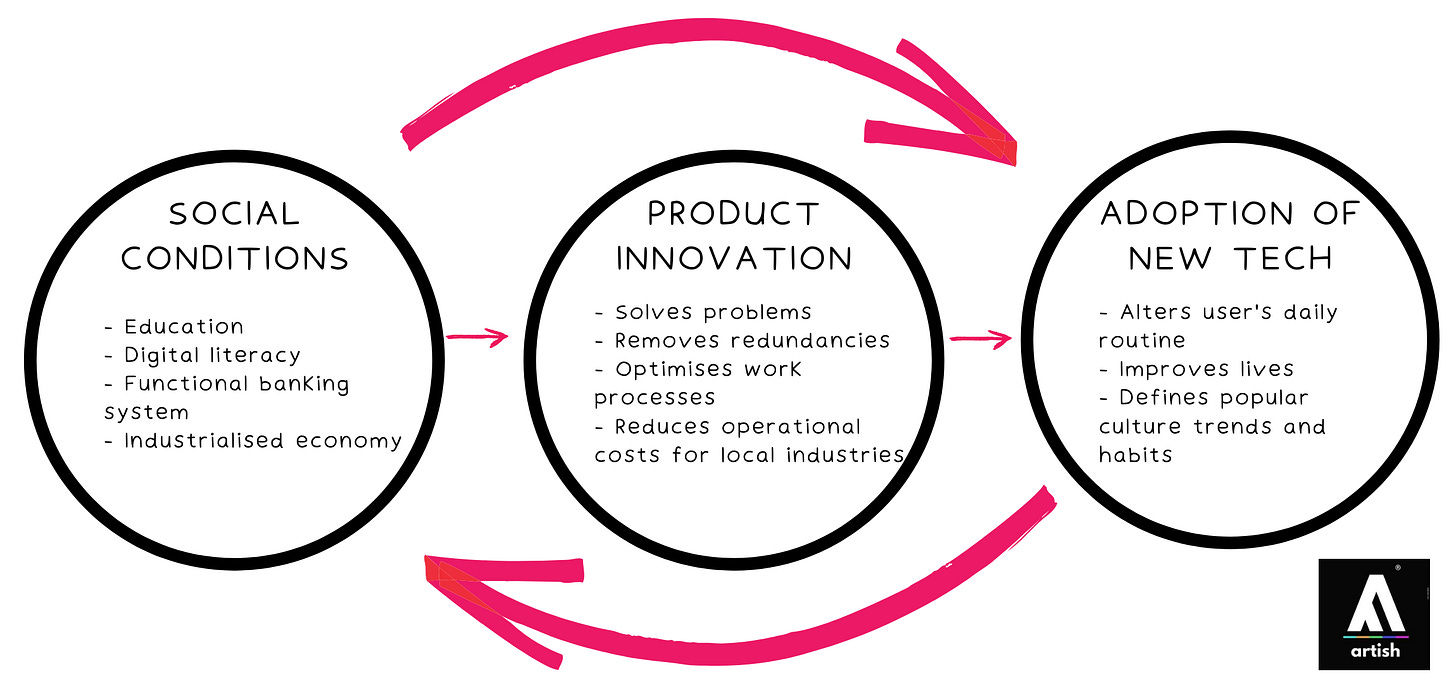

Our thesis is based on a concept called the "Axiom Adoption Paradox” coined by ARTISH Founder, Toye Sokunbi as the gap between innovation and its real-life usage, resulting from the adoption of new technology as an axiom, instead of a progression of systematic changes in a particular sector, industry or ecosystem.

It re-examines the philosophical riddle of the egg and the chicken; If you must innovate, you need the adoption of new technology, and without the adoption of new technology, you cannot innovate. So which should come first? The new technology or the mass of users who can apply said technology to improve their lives?

The "Axiom Adoption Paradox” from our research, is most common in developing economies where adoption of new technology happens at the consumer level with very little oversight or involvement by local industries. In Africa’s creator economy, the music industry went from CDs to digital streaming without figuring out piracy, music distribution or free downloads. This is a wide contrast to capital-rich Western & Eurocentric creator economies where, that space between physical CDs and Spotify had a whole sustainable ecosystem of record labels, jukeboxes, royalties, Billboard Charts, Napster, MySpace, iPods and more.

NORMAL ADOPTION CYCLE

THE AXIOM ADOPTION PARADOX

In a globalising world, working around the effects of the Axiom Adoption Paradox on innovation is crucial, if Africa’s creator economy is to benefit from today’s tech-enabled multilateral trading system. Western capital still controls much of the pace of innovation around the world, but that’s not because creatives of colour don’t have great ideas or haven’t been solving problems with great products. Rather it’s because founders and investors are drowning under the weight of architecting creator economy ecosystems virtually out of nowhere, without any of the pre-existing social or technological conditions that should engender adoption of technology that’s supposed to empower people

You don't start to think of the consequence of the Axiom Adoption Paradox in nation-building until you think of things laterally, using say the oil sector as an example. It’s ironic, but the same corporations invested in oil today are the ones best positioned to invest in clean energy, and that's because of the experience they have had with years of distribution networks, lobbying, union relations and international policy.

The Axiom Adoption Paradox is why ARTISH pivoting on the premise of building a virtual community that will sit between the fintech of today, which is mobile money, mobile banking, co-sharing services and more, and the fintech of tomorrow, led by the creator economy and powered by blockchain, virtual currencies, borderless payments and cloud marketplaces.

It’s not often said, but many tech products that exist today still don’t have enough use-cases to optimise their revenue funnels. You either have products like YouTube and Twitter that have a multiplex of utilities for education and entertainment, but their revenue funnelling is still limited to subscriptions and advertising. Or you have FinTech products that have obvious revenue funnels but no profitability because there are just not enough use-cases for their application in real life.

To contextualise, the state of African innovation, we’d like to narrow down specifically on FinTech and why scaling use-cases for many products supposedly targeted at the creator economy, is still suffering from latency issues. As you're probably aware, the main innovation in fintech today is social money (an example we have seen successful peer-to-peer tech like WeChat in China) and applied blockchain technology. That’s because social money as a phenomenon was a consequence of big-tech platforms like Facebook, Instagram and Twitter not giving users the ability to monetise their content, or having arbitrary control over monetisation and payouts. Today, NFTs and platforms like Roll and Everpedia, are replacing the user-generated content model with user-generated capital. What this means is that users are able to convert the traction gained on their content into cryptocurrency in real-time. This is incentivising the emergence of new generation virtual communities where users have total fiscal control that converts digital engagement into tradable value.

While cryptocurrency still has limited application, the future of financial sustainability, will be driven by blockchain technology. We want to prepare players in the creator economy — especially, Gen-Z humanity’s first digital native generation—to benefit from the biggest gains of the labour market of tomorrow by giving them an fulfilling career path characterised by independence and access to borderless financial services that will enable them to thrive in the emerging digital economies of tomorrow. This is why it has come down to us to build an ARTISH app.

The turn of the tide is gradual, but for the first time in human history, remote work is revolutionising age-old corporate norms and zillennials growing up today are a step further to living in a fully digital economy. If peer-to-peer transactions will solve the problem of use-cases and lead to the growth of next-generation virtual communities, the world needs products like ARTISH with possibilities for multi-level stakeholder engagement at the corporate, individual and possibly institutional levels.

Ladies and gentlemen, this is how we all win. Please join our waitlist.